The Subscription Spaghetti

Picture this: You’re the CFO of a growing SaaS company. Five product lines with different pricing models. Thousands of customers on various subscription tiers. And when the board asks “What’s our net revenue retention?"—finance and product give different answers.

That was Seattle Co’s reality.

They’d built great products and acquired customers rapidly. But their back-office systems hadn’t kept pace. Subscription data lived in Stripe. Usage data in their product database. Financial data in D365. And a finance team spending more time reconciling numbers than analyzing them.

They were stuck.

Our board deck took two weeks to prepare. And we still weren’t confident in the numbers.

That’s the kind of chaos we walked into. This wasn’t about dashboards. This was about investor credibility and operational sanity.

The Problem Beneath the Surface

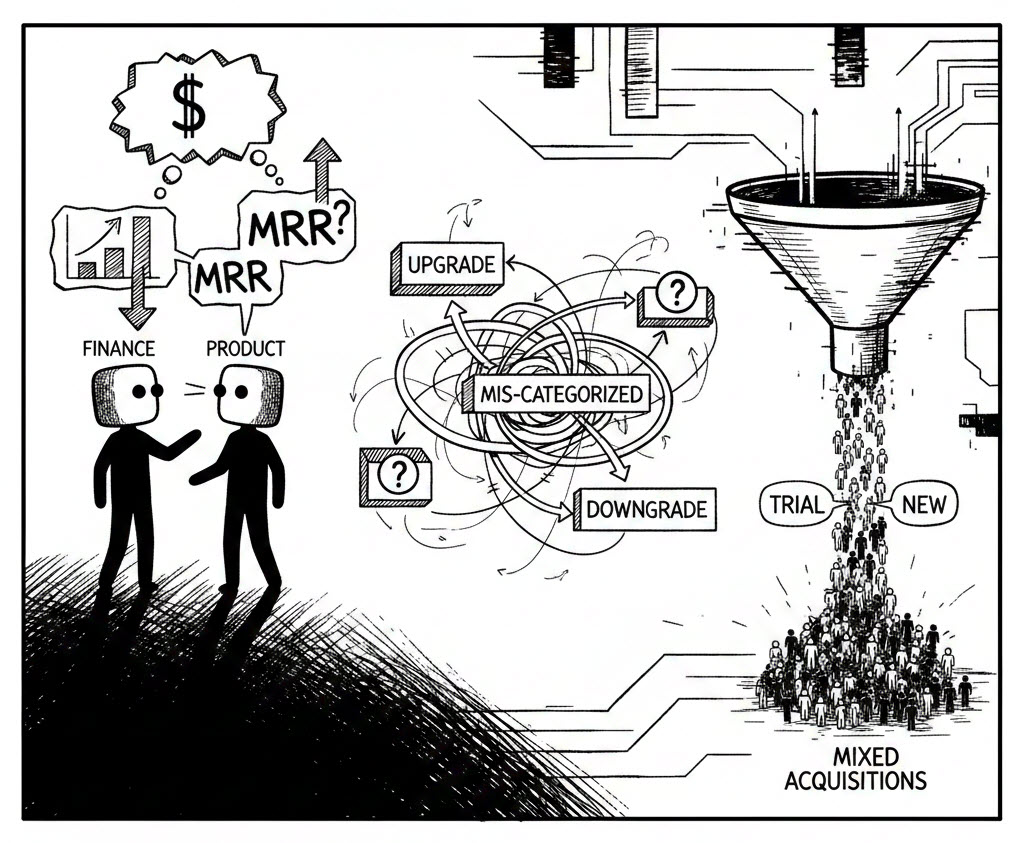

When we sat down with Rachel from Finance and David from Product, the scope of the challenge became clear. It wasn’t just about metrics. The problems ran deep:

The Subscription Data Nightmare

- MRR calculated differently by finance and product teams

- Upgrades and downgrades not properly categorized

- Trial conversions mixed with new customer acquisitions

The Revenue Recognition Maze

- ASC 606 compliance requiring complex allocation across performance obligations

- Multi-year contracts with different billing and recognition schedules

- Professional services revenue mixed with subscription revenue

The Cohort Analysis Dilemma

- Customer acquisition dates that didn’t match first payment dates

- Churn definitions that varied by product line

- No way to see lifetime value by acquisition channel

As Rachel put it: “We have three different MRR numbers depending on who you ask. The board is starting to notice.”

The existing system just wasn’t built for this complexity.

Enter the Creators

This is where Bish and Bhavana stepped in.

Their approach wasn't to throw technology at the problem. It was to understand it first. Hours of calls. System walkthroughs. Questions like "What happens when a customer upgrades mid-month?" and "Walk me through how you recognize revenue on a three-year contract."

The Key Insight

The breakthrough came when we realized the core issue: Seattle Co didn't need more reports. They needed authoritative reports, with one definition of truth, that both finance and product could trust.

Bhavana proposed a three-pronged approach:

- Unified Subscription Model reconciling billing system data with financial records

- Standardized Metric Definitions aligned with SaaS industry standards

- Cohort-Based Analysis enabling true customer lifetime value calculations

No more dueling spreadsheets. No more board meeting surprises.

The Proposed Solution

We invoked the 5 Standards of the Report Factory:

1. ETL Plumbing

Solidifying the data pipeline from D365 F&O to Microsoft Fabric. Subscription data, usage metrics, and financial transactions—all flowing into one place.

2. Data Modeling

A single source of truth. One data model that reconciled subscription events with financial records. We built custom views to calculate SaaS metrics using industry-standard definitions.

3. Visual Hierarchy

Flyovers for executives who need ARR and retention summaries. Drill-downs for product managers who need cohort-level details. Everyone sees what they need to see.

4. Maintenance

Systems that can be managed even if outsourced. Documentation. Standards. Repeatability. No platform lock-in.

5. Portability

Architecture that can be moved between platforms without losing functionality.

The Transformation

Our board deck now takes two days instead of two weeks. And we actually trust the numbers.

Here’s what changed:

Before:

- 5 product lines, 5 different metric definitions

- MRR that didn’t reconcile to recognized revenue

- Cohort analysis that took weeks to produce

- Board meetings with conflicting numbers

After:

- Unified subscription metrics across all products

- MRR that ties directly to financial statements

- Real-time cohort analysis by acquisition channel

- Single source of truth for all stakeholders

The moment of truth came during their next board meeting. Rachel presented the metrics with full confidence, drilling into any cohort or product line the board wanted to see. David’s reaction?

“For the first time, product and finance were presenting from the same deck. The board noticed.”

That’s the sound of credibility being restored.

The Bigger Picture

What Seattle Co taught us goes beyond reporting. It’s about the future of how SaaS companies operate.

As Joe shared during one of our sessions:

I don’t think there’s going to be a reporting department in the future. What’s going to happen is that people will write an operating system that runs the business. And reporting is just for the AI agents, it’s just for the operating system.

The materiality of stopping and thinking—of pausing to look at printouts and decide what to do—is a massive cost to any organization. Seattle Co’s transformation is a step toward a future where the right information flows to the right decisions automatically.

Your Turn

Seattle Co’s journey from stuck to unstuck took weeks, not months. The investment was measured in thousands, not hundreds of thousands.

Every organization has a story. What’s yours?

Are you:

- Struggling with subscription metrics that don’t match financials?

- Drowning in reconciliation between systems?

- Presenting conflicting numbers to your board?

The water might be rising. But you don’t have to stay stuck.