The Bleeding Numbers

Picture this: You’re the CFO of a growing healthcare network. Twelve facilities across three states. Each one running their own version of financial tracking. And when the board asks for a consolidated P&L, your team disappears into Excel for three days.

That was Atlanta Co’s reality.

They’d invested heavily in D365 F&O, but the promise of unified reporting never materialized. Their previous implementation partner had moved on, leaving behind a patchwork of custom reports that nobody fully understood. Meanwhile, compliance deadlines loomed and the finance team was burning out.

They were stuck.

When your CFO is manually copying numbers between spreadsheets at 11pm before a board meeting, something is fundamentally broken.

That’s the kind of urgency we walked into. This wasn’t about nice dashboards. This was about organizational survival.

The Problem Beneath the Surface

When we sat down with Marcus from Finance and Dr. Chen from Operations, the scope of the challenge became clear. It wasn’t just about consolidation. The problems ran deep:

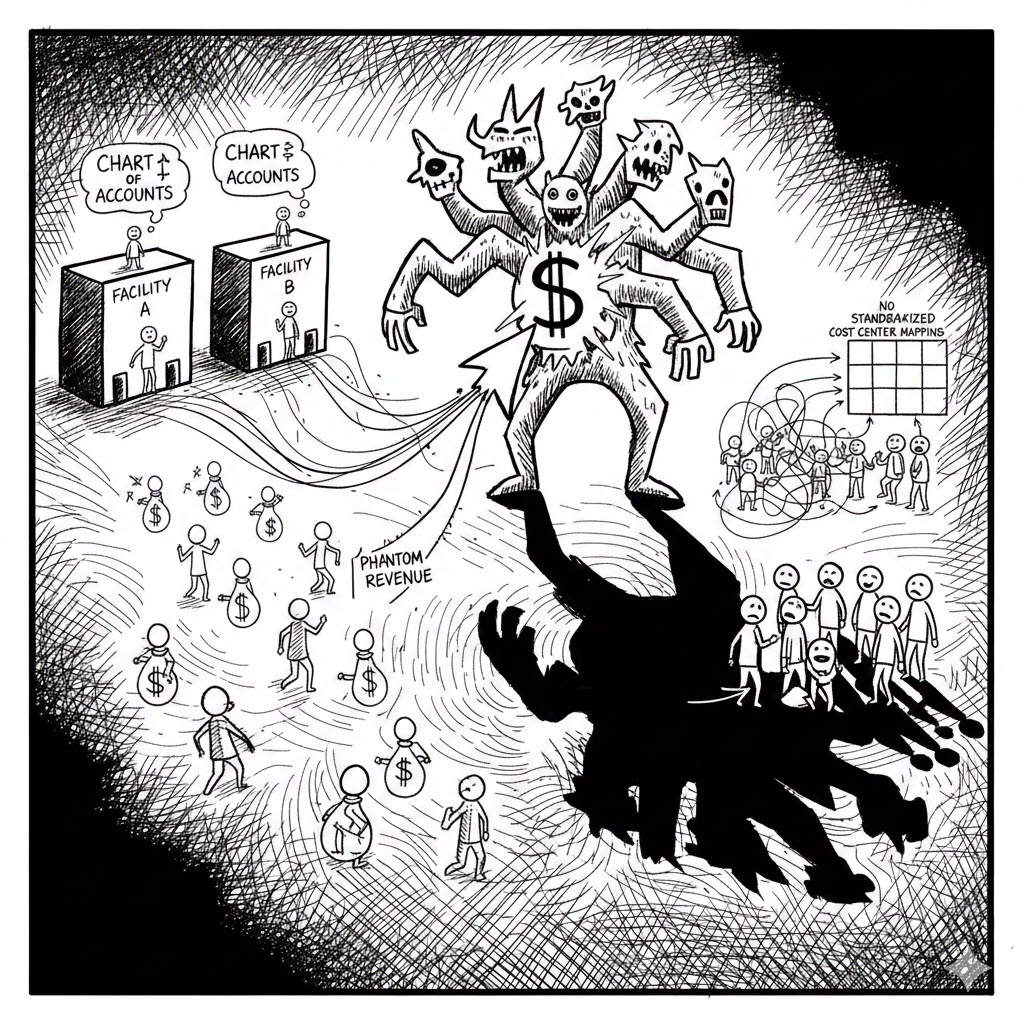

The Multi-Entity Nightmare

- Each facility operated as a separate legal entity with different chart of accounts

- Intercompany transactions created phantom revenue that inflated totals

- No standardized cost center mapping across facilities

The Revenue Recognition Maze

- Patient services billed differently across facilities

- Insurance reimbursements hitting at unpredictable intervals

- Grant funding that needed separate tracking but kept getting mixed with operating revenue

The Compliance Dilemma

- HIPAA requirements meant certain financial data couldn’t be freely shared

- Audit trails that existed in theory but not in practice

- No way to prove data lineage when regulators came knocking

As Marcus put it: “We have the data. We just can’t trust it. And in healthcare, that’s not just inconvenient—it’s dangerous.”

The existing system just wasn’t built for this complexity.

Enter the Creators

This is where Bish and Bhavana stepped in.

Their approach wasn't to throw technology at the problem. It was to understand it first. Hours of calls. Screenshots flying back and forth. Questions like "What happens when a patient transfers between facilities?" and "Walk me through your month-end close process."

The Key Insight

The breakthrough came when we realized the core issue: Atlanta Co didn't need more reports. They needed trusted reports, with clear lineage, delivered to the right stakeholders.

Bhavana proposed a three-pronged approach:

- Entity Consolidation Layer for true enterprise-wide visibility

- Intercompany Elimination to remove phantom transactions

- Role-Based Distribution to ensure compliance with data access policies

No more manual consolidation. No more questioning whether the numbers were real.

The Proposed Solution

We invoked the 5 Standards of the Report Factory:

1. ETL Plumbing

Solidifying the data pipeline from D365 F&O to Microsoft Fabric. Clean data in, clean data out—with full audit trails for compliance.

2. Data Modeling

A single source of truth. One data model that all 12 facilities could trust. We built custom views to handle the entity-to-cost-center mapping that didn’t exist in the base system.

3. Visual Hierarchy

Flyovers for executives who need the consolidated picture. Drill-downs for facility managers who need their specific details. Everyone sees what they need to see—and nothing they shouldn’t.

4. Maintenance

Systems that can be managed even if outsourced. Documentation. Standards. Repeatability. No platform lock-in.

5. Portability

Architecture that can be moved between platforms without losing functionality or compliance controls.

The Transformation

Our CFO actually took a vacation last month. First time in two years.

Here’s what changed:

Before:

- 12 facilities, 12 different versions of “the truth”

- Manual consolidation taking 3+ days each month

- Reports that auditors questioned

- No automated distribution with access controls

After:

- Single source of truth across all facilities

- Automated consolidation with intercompany elimination

- Clear data lineage for compliance

- Role-based report distribution respecting data access policies

The moment of truth came during their next board meeting. Marcus presented the consolidated financials in real-time, drilling into any facility the board wanted to see. No scrambling. No “let me get back to you on that.”

“The board actually asked if we’d hired a new analytics team. We just smiled.”

That’s the sound of an organization becoming unstuck.

The Bigger Picture

What Atlanta Co taught us goes beyond reporting. It’s about the future of how healthcare organizations operate.

As Joe shared during one of our sessions:

I don’t think there’s going to be a reporting department in the future. What’s going to happen is that people will write an operating system that runs the business. And reporting is just for the AI agents, it’s just for the operating system.

The materiality of stopping and thinking—of pausing to look at printouts and decide what to do—is a massive cost to any organization. Atlanta Co’s transformation is a step toward a future where the right information flows to the right decisions automatically.

Your Turn

Atlanta Co’s journey from stuck to unstuck took weeks, not months. The investment was measured in thousands, not hundreds of thousands.

Every organization has a story. What’s yours?

Are you:

- Drowning in multi-entity consolidation chaos?

- Struggling with data you can’t trust?

- Waiting on reports that never quite satisfy auditors?

The water might be rising. But you don’t have to stay stuck.